What’s In a Name? “Secondary” Perils May Be Outliving Theirs

Max Dorfman, Research Writer, Triple-I (11/3/2021)

Secondary perils increasingly are driving catastrophe insurance losses, leading some in the industry to suggest that the “primary/secondary” distinction may no longer be as useful as it once was.

Generally defined as smaller to mid-sized events or effects following a “primary” catastrophe (think hurricane-induced floods and storm surge or fires following an earthquake), they’ve long been seen as less costly and deserving to be categorized differently from larger-scale events.

“The term has helped the industry to put under-represented natural catastrophe risk into the spotlight of insurance risk underwriting and management,” said Martin Bertogg, managing director responsible for catastrophe perils at reinsurer Swiss Re. “It resonates with industry participants and observers and highlights the need to address claims arising from small to medium-sized natural catastrophes.”

But more than 60 percent of last year’s insured catastrophe losses of $54 billion were caused by such perils, insurance broker Aon said in its report “Reinsurance Market Outlook – September 2020.” Swiss Re put the insured losses from secondary perils at more than 70 percent. This caused 2020 to be the fifth costliest for insured losses on record. Swiss Re said 62 percent of all natural-catastrophe-related claims in 2018 were caused by secondary perils, and, between 2016 and 2018, such perils caused more than 50 percent of insured losses.

And 2021 has further demonstrated the high risk and costs associated with secondary perils. In February, meteorological events converged in the south-central United States to produce a freeze event that caused a massive cold wave across Texas. In Western Europe, 189 people died after catastrophic flooding hit Germany, Belgium, and the Netherlands. In September, Greece was hit by wildfires that were followed by major flooding and landslides in October.

The Challenge

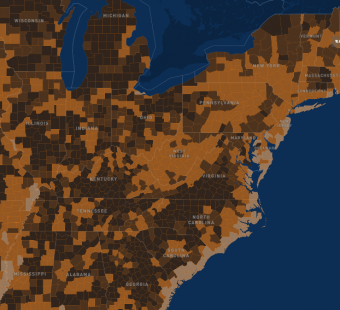

Because of the ubiquity of secondary perils – combined with their highly localized nature, which can be substantially shaped by human behavior – these events often are regarded as too complex to model. Rapid urbanization, for example, by increasing the amount of paved surface in previously undeveloped areas, can result in rainwater having nowhere to go during and after a storm.

Traditional models use historic loss data to map, price, and underwrite. More recently, however, variables such as climate risk and population shifts have forced insurers to consider how to develop models for secondary perils.

“Traditional cat modeling approaches should leverage new technologies and data, such as machine learning and social media, to build robust secondary perils tools,” according to Swiss Re. “More importantly, it requires insurers, reinsurers, clients, as well as partners from the industry and public sector, working together in a collaborative ecosystem that enables data access throughout the value chain and invests in new approaches for risk assessment.”

Additionally, satellite imagery and mobile data — specialized by region — can be used to evaluate local risks posed by weather-related secondary perils. This can give insurers insights that facilitate the innovation of a larger product range, with an increased focus on distribution of catastrophe covers.

For example, Swiss Re has affiliated with Mao County in China to deliver the country’s first county-level natural catastrophe program, insuring Mao County and the Tibet Plateau. The program also insures the county for the effects of landslides, heavy rainfall, and public safety accidents. Swiss Re has also backed insurance solutions that protect against perils like excess rainfall from hurricanes and wind damage for the Caribbean Catastrophe Risk Insurance Facility.

With the ever-increasing cost of these perils, innovation is required to mitigate them wherever possible. Indeed, “secondary” perils may require the same attention as “primary” ones—perhaps more.